carried interest tax changes

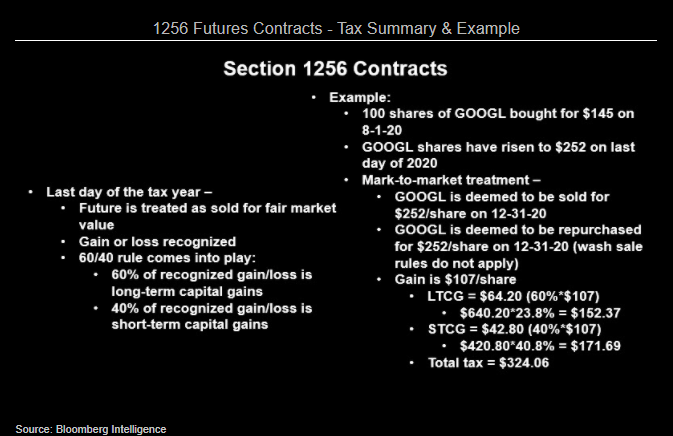

However carried interest is often treated as long-term capital gains for tax purposes subject to a top tax rate of 238 20 on net capital gains plus the 38 net investment income tax. The TCJA extended the time that investment funds need to hold investments to qualify for long-term capital gainsat least three years instead of just one.

Accounting Taxation Income Tax Deductions Lic Donation Mediclaim Pension Fund Home Loan Repayment Bank Fdr Etc Ca Income Tax Tax Deductions Tax Refund

Some changes came about when the Tax Cuts and Jobs Act TCJA went into effect in 2018 so you might have to pay ordinary income tax rates on carry under some circumstances.

. Do I Need To Pay Income Tax on Carried Interest. Trillion in assets under managementan increase of nearly 40 over the past four years. In January 2021 the US.

Detailed descriptions of the Administrations tax proposals were provided in the Treasury Green Book. The carried interest changes would apply to tax years beginning after December 31 2021. Carried interest is subject to capital gains tax.

The current tax treatment of carried interest is the result of the intersection of several parts of the Internal Revenue Code. The carried interest tax break for private equity and venture capital firms is once again in the spotlight and founders could feel the results. Bush has vowed to eliminate the tax break that allows compensation to be taxed at the lower capital-gains rate yet carried interest continues.

Lobbyists shielded carried interest from Bidens tax hikes top White House economist says Published Thu Sep 30 2021 1243 PM EDT Updated Thu Sep 30 2021 202 PM EDT Christina Wilkie. For more articles like this. As part of their proposals the administration addressed the beneficial treatment of Carried Interest in current.

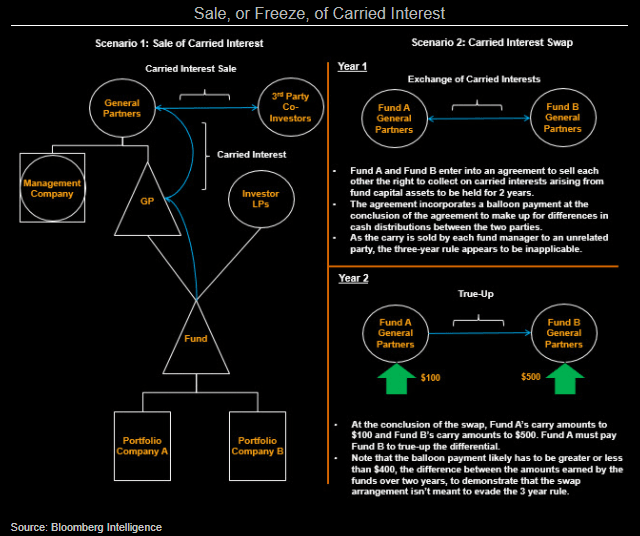

According to a press release issued by the Finance Committee in conjunction with the bills introduction the proposed legislation would close the entire carried interest loophole re-characterization of income from wage-like income to lower-taxed investment income and deferral of tax payments It further states that other versions. A private equity fund typically uses carried interest to pass through a share of its net capital gains to its general partner which in turn passes the gains on to the investment managers figure 1. Annual management fees are taxed as ordinary income currently subject to a top tax rate of 37.

115-97 extended the holding period for certain carried interests applicable partnership interests APIs to three years to be eligible for capital gain treatment. A carried interest is a form of profits interest that gives a service provider the right to share in future partnership profits but is not taxable upon receipt because it. Carried Interest Tax Proposal Threatens Charitable Giving.

Posted in Featured Q3 2021 Issue. This tax information and impact note deals with changes to the carried interest rules for Capital Gains. The law known as the Tax Cuts and Jobs Act PL.

Some view this tax treatment as unfair because the general partner. The preferential tax rate is especially important for a private equity fund and its managers. Carried interest is very generally a share of the profits in a partnership paid to its manager.

Carried interest is generally taxable as capital gains in the UK - albeit since 2015 at higher rates than other capital gains and at income. Clearly not all carried interest is the same. It made sense for PE firms to operate as partnerships when the corporate tax rate was 35 and there was a lower tax rate on capital gains that also applied to the fund managers carried interest.

On May 28 2021 the Biden administration released its fiscal year 2022 budget. Final Carried Interest Regulations. 1068 The Carried Interest Fairness Act of 2021 has been introduced in Congress to eliminate capital gains tax treatment for carried interests.

Despite this change HR. As of the second quarter of 2019 private equity and hedge funds had roughly 143. Capital Gains Tax.

The carried interest break is relatively small for a tax expenditure -- costing about 14 billion over a decade. Carried interest tax treatment. In the event that a double tax charge arises the individual will be allowed an offsetting credit in order to avoid double taxation ITA 2007 s 809EZG and TCGA 1992 s 103KE.

The managers pay a federal personal income tax on these gains at a rate of 238 percent 20. Department of Treasury and the Internal Revenue Service released final regulations the Final Regulations under Section 1061 of the Internal Revenue Code of 1986 as amended the Code. Modifying the limitation on deduction of business interest expense The bill would amend Section 163j to apply the interest limitation at the partner level instead of at the partnership level as under current law effective for tax years beginning after December 31 2021.

The final regulations retain the basic structure of the proposed regulations with certain changes made in response to comments. Last month the House Ways and Means Committee marked up the Build Back Better Act to include a provision modifying how carried interest is treated under the tax code. While the final regulations simplify key exceptions and contain favorable changes ambiguity continues for investment fund managers.

Many PE funds considered converting to C corporations after TCJA lowered the corporate rate to 21 since the corporate form has other advantages including. Assuming a 2x return on a 10MM fund versus a 1 Billion fund a 20 carried interest is 2MM versus 200MM respectively. The 17 tax differential.

Green Book proposed changes - Mazars - United States. Latham Watkins Transactional Tax Practice January 28 20 21 Number 2853. The Carried Interest tax regimes replace any CGT charge which would have already arisen under pre-existing rules but does not replace any pre-existing income tax charge.

Code Section 1061 was enacted in 2017 to place limits on the ability of carried interest arrangements to be. The Biden Administration has also included a provision to eliminate capital gains treatment for carried interests in its American Families Plan presented to Congress on May 28 2021. Every president since George W.

This tax rate is lower than the income tax or self-employment tax which is the rate applied to the management fee. Key Takeaways for Private Fund Sponsors.

Internal Vs External Audit Accounting And Finance Internal Audit Risk Management

Love Only By Peter Douglass Friend Of Mine That Self Published His First Book Send Him A Congrats Love Only Songs To Sing Finding Love

In 2011 Convey Sponsored A Tax And Regulatory Survey Carried Out By The Institute Of Financial Operations During A Time Of U Tax Infographic Accounts Payable

Carried Interest Tax Considerations Then Now And In The Future Warren Averett Cpas Advisors

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

10 Things You Need To Know About The Eu Gdpr Privacy Laws In The U S Vs Eu General Data Protection Regulation Privacy Law Cyber Law

The Surprising Ways China Affects The U S Economy Global Economy Command Economy Economy

Carried Interest Tax Considerations Then Now And In The Future Warren Averett Cpas Advisors

Carried Interest In Venture Capital

Tax On Resp Withdrawal Lower The Tax Maximize The Benefit Manulife Investment Management

Signs Your Business Might Qualify For R D Tax Credits Income Tax Tax Deadline Budgeting Money

Income Taxes S Corporation The Ides Of March Finance

Real Estate F X Fund Managers Will Escape Carried Interest Caps Bloomberg Professional Services

Real Estate F X Fund Managers Will Escape Carried Interest Caps Bloomberg Professional Services

Download Bank Statement Template 15 Statement Template Bank Statement Cash Flow Statement

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)